schedule c tax form llc

June 6 2019 258 AM. Build Paperless Workflows with PDFLiner.

What Is An Irs Schedule C Form

This is the link for the IRS codes for section B the codes will be at the bottom of the website httpswwwirsgovinstructionsi1040scHelp support my vide.

. Even simple sole proprietorships usually require multiple other. Owners shareholders of an LLCC-Corp pay taxes on two levels. However several circumstances might allow that partnership to be considered as a qualified joint venture while.

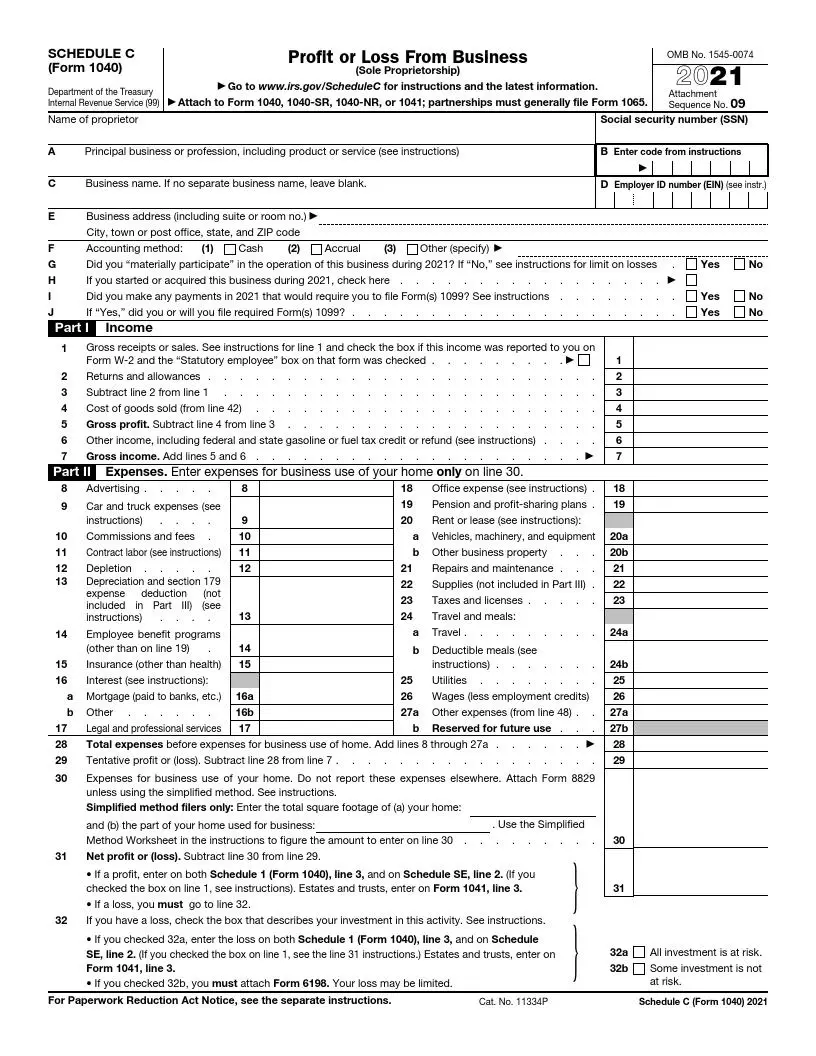

Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. If you run your own. Name of proprietor.

This blog post will be exploring what a Schedule C IRS form is why 1099 workers need to file it and how to fill out the form. Schedule C Form 1040 is a form attached to your personal tax return that you. Whether your business has a profit loss or gain.

Get the tax answers you need. Personalize Your Forms Download Instantly. Estates and trusts enter on.

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. A sole proprietor must file IRS Schedule C. Schedule 1 Form 1040 line 3 and on.

Information about Schedule C Form 1040 Profit or Loss from Business. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor.

Long story short the profit or loss you. I already filed my personal tax return. Carls response is correct if the LLC has NOT made the election to be taxed as a corporation.

Edit Sign and Print IRS Schedule C Form 1040 Tax Form on Any Device with pdfFiller. About Form 1041 US. The profit is the amount of money you made after covering all.

Return of Partnership Income. Ad Find out what tax credits you might qualify for and other tax savings opportunities. About Form 1099-MISC Miscellaneous Income.

Tax returns for partnerships must be filed on Form 1040. In most situations there isnt much of a. If you checked 32b.

The purpose of Schedule C is to report how much money you made or lost in your business during the tax year. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Printable SCHEDULE C Form 1040 blank sign forms online.

Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. If you checked the box on line 1 see the line 31 instructions. Schedule SE line 2.

Get Information for Schedule C. If you operate your business as a single-member limited liability company LLC you will also use Schedule C for your business income taxes. It is a form that sole proprietors single owners of businesses must fill out in the United States when.

Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. Schedule C is a place to record the revenue from your business and all the costs associated with running your business. The IRS website has a copy of the Schedule C tax form as well as Instructions for Schedule C.

The first section of the Schedule C is reserved for your business information. Its part of the individual tax return IRS form 1040. You will then complete Schedule SE and attach it to your individual tax return Form 1040.

Form 1041 line 3. Income Tax Return for Estates and Trusts. The form is titled Profit or Loss from Business Sole.

Get 1040-C Form Schedule C Free fillable form in PDF DOC formats Online examples with instructions guides Send 1040C Form to IRS now. You and your spouse must each report your individual shares of the income generated. You will file the LLCs federal income tax return using IRS Form 1065 US.

Were going to review this in detail below. Schedule C is an important tax form for sole proprietors and other self-employed business owners. However if the LLC HAS made the election to be taxed.

Talk to a 1-800Accountant Small Business Tax expert. The Schedule C tax form is used to report profit or loss from a business. The form is part of your personal tax returnSchedule C is typically filed with Form 1040.

I started an LLC in the middle of 2016 for my personal photography business but I never actually started the business up I didnt have time. If you have employees that you withhold federal taxes from you will then file payroll. The LLCC-Corp pays corporate taxes current nominal rate is 21 on its taxable.

Talk to a 1-800Accountant Small Business Tax expert. Edit Fill Sign Share Documents. Eliminate Errors Surprises.

Sole proprietors must also use a Schedule C when filing taxes. Get the tax answers you need. Its used to report profit or loss and to include this information in the owners.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. Ad Fillable SCHEDULE C Form 1040. The net profit or loss from this schedule is reported on.

How To Fill Out Schedule C For Business Taxes Youtube

What Is Schedule C Tax Form Form 1040

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

What Is A Schedule C Tax Form H R Block

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Self Employment Income How To File Schedule C

How To Fill Out Schedule C For Business Taxes Youtube

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Is An Irs Schedule C Form

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

What Is A Schedule C Tax Form H R Block

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube